The Flavourful Future of Beer: Innovating for the Next Generation

Younger consumers are driving a wave of innovation in the beer market with their appetite for flavoured alcoholic beverages. Flavoured beer launches grew by 28% globally between 2018 and 2022 as brewers responded to the growing popularity of flavoured variants in other alcoholic segments like hard seltzers and ready to drink cocktails. (Innova)

Younger millennial and Gen Z consumers will be a key driver for future growth in the category and catering to their taste preferences will be key for brands looking to grow market share in this space.

Flavoured beer brewing up a storm

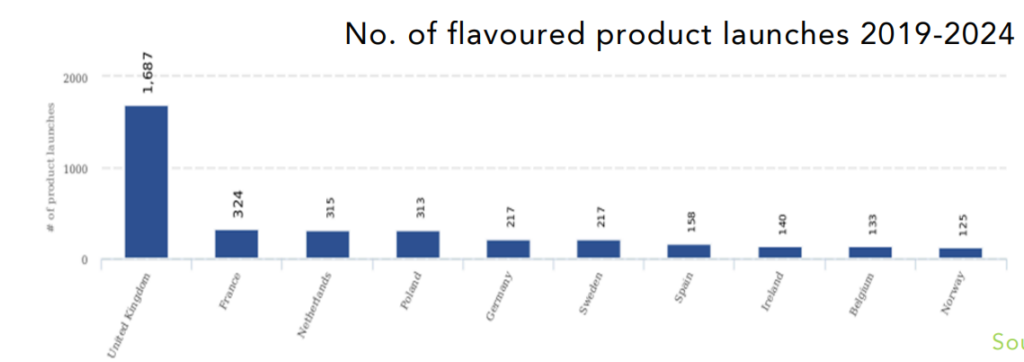

Between 2019 and 2024, around 21% of new beer launches in Europe were flavoured. The launch activity in Europe is mainly being driven by the UK which has seen five times more launches in this period than France which is the second most active country in this segment. (Innova)

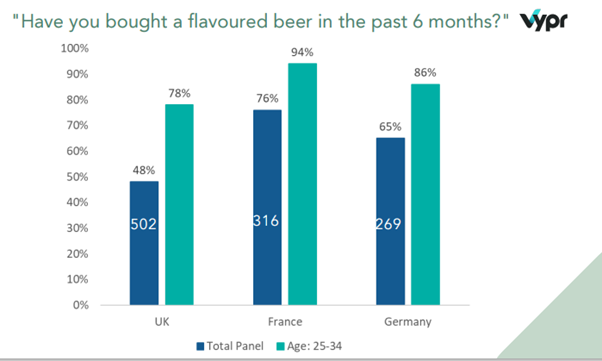

When looking at the beer market as a whole, there is a generational shift happening in terms of flavour preferences and how the market is choosing to respond. Younger consumers are more likely to have purchased a flavoured beer than those in older age demographics who tend to gravitate to more traditional varieties. Research by Synergy in partnership with Vypr shows that consumers aged 25-34 are buying flavoured beer at a rate above average for the total population across 3 key European markets; UK, France and Germany.

Younger consumers are generally known for having an appetite for novelty, and the beer market is no different. When we asked under 35s what they were looking for in flavoured beer, the top attributes mentioned were taste (UK, Germany France), variety (UK) and refreshing (Germany, France).

Best Bitter

Bitterness is a key taste component in beer and it’s apparent that younger consumers still want this to shine through, despite their growing demand for flavour innovation. Research conducted by Synergy in partnership with Vypr revealed that 56% of consumers aged 25-34 in the UK like a bitter taste profile in beer – in Germany this increased to 69% and in France it stood at 78%. By exploring flavours that harmonise beer’s bitter notes, we can create the ideal balance for today’s consumers.

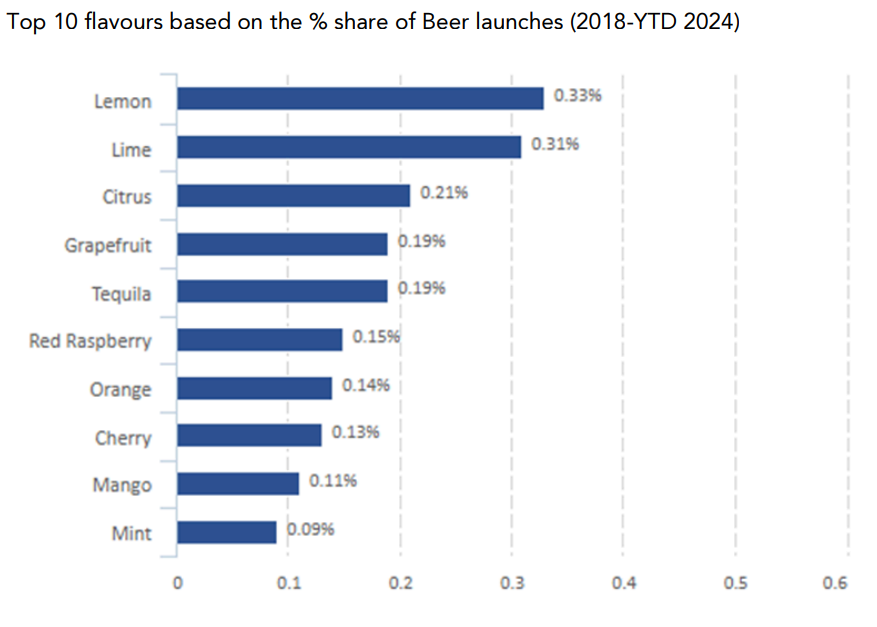

Flavours such as mandarin, lime, orange and grapefruit can work well with the bitterness of beer and could be the optimal choice for today’s consumers. Brewers in Europe have already latched onto this with citrus profiles dominating flavoured beer launches since 2018. The demand in citrus profiles has resulted in a surge in popularity of sour beers, catering to consumers who crave acidic flavour profiles.

Looking at flavoured launches more closely, there is some disparity between flavour launches from large companies (top 100 global companies based on sales) and small companies. While citrus profiles tended to dominate launches from large companies, smaller companies were more experimental introducing profiles like milk chocolate, vanilla and coffee. (Innova)

Appealing to younger consumers

Under 35s who are already buying flavoured beers more than the overall population will be a key driver in the category’s growth. Experimenting with flavours that meet consumers’ demand for variety and balance, will be vital for brands wanting to increase their market share over the next few years.

How Synergy can support your next development

Synergy can support your next flavoured beer development with a range of authentic natural flavours and extracts developed with alcoholic beverages in mind. In addition, Synergy’s hop essences use proprietary extraction methods to capture the full aromatic and flavour characteristics of traditional dry hopping. As a result, hop essences can completely replace or be used in addition to the dry hopping process to a create a custom taste solution and are available in multiple hop varietals.

insights