Plant-based consumer insights

Plant-based consumer insights

The plant-based consumer cannot be bucketed into a singular identity. As health and wellness trends continue to redefine the food and beverage industry, plant-based innovation is at an all-time high. Consumers opting for plant-based alternatives are no longer a niche group.

Synergy Flavours conducts primary research studies and analysis to better understand the behaviours and preferences of consumer groups, delivering actionable insights to influence product innovation. The following data analysis takes a deep-dive into plant-based consumers seeking dairy-alternatives.

Meet today’s Consumer

The majority of US consumers who purchase plant-based, dairy alternatives are also purchasing dairy-based products.

Source Primary Research 2019

Our Primary Resource Suggests

Consumers ages 50 and older, including late Gen X and Baby Boomers are consuming the majority of dairy-based ‘only’ products, whereas younger generations are more likely to purchase plant-based products.

Consumers ages 25-34, a majority of the millennial generation, are purchasing plant-based and dairy-based products more than other ages.

Consumers ages 18-24, which includes older Gen Z and younger millennials, are purchasing the majority of plant-based ‘only’ products.

Plant based dairy alternative purchase motivations

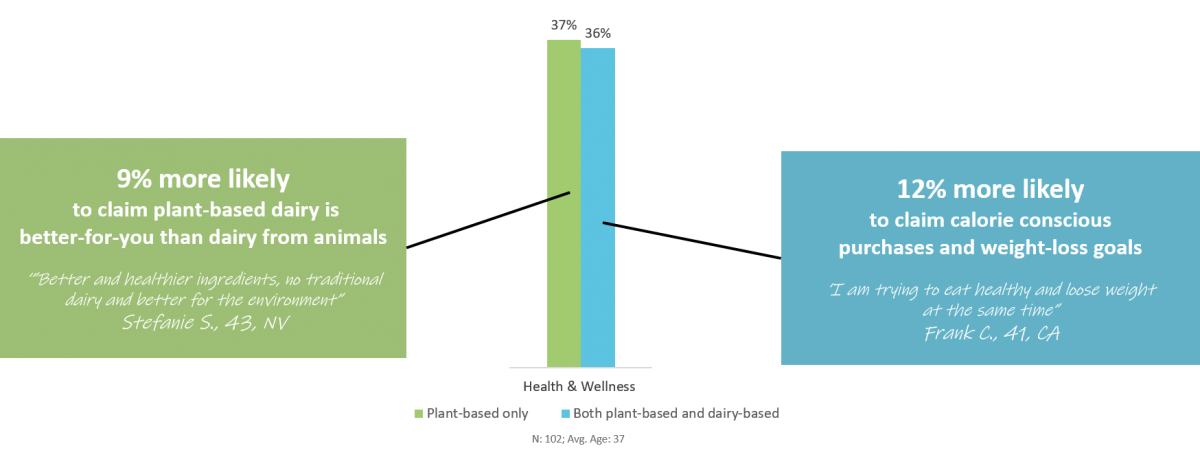

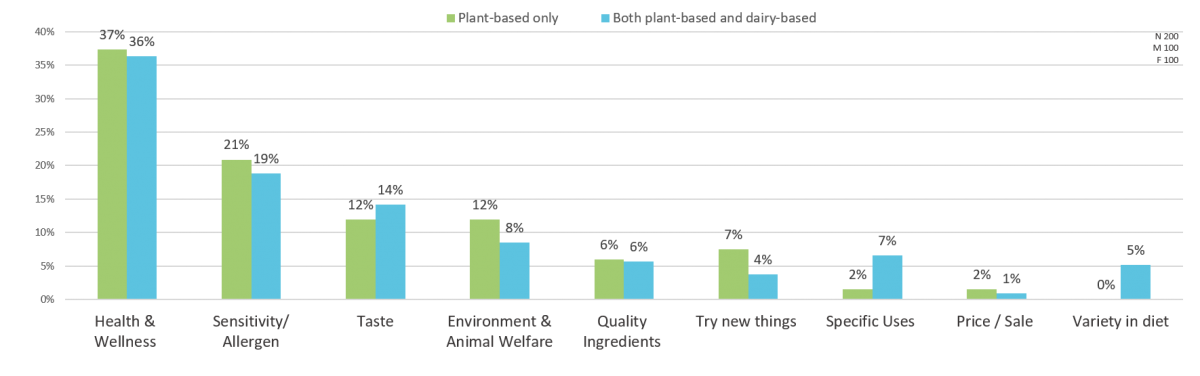

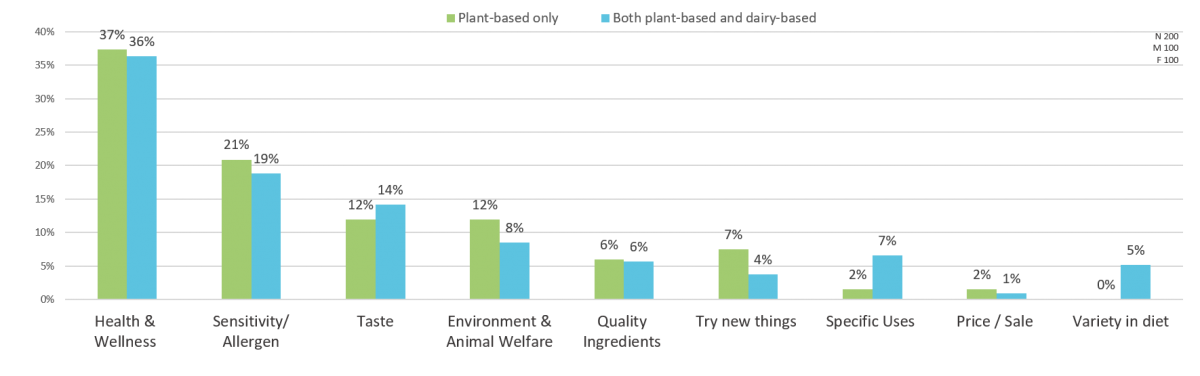

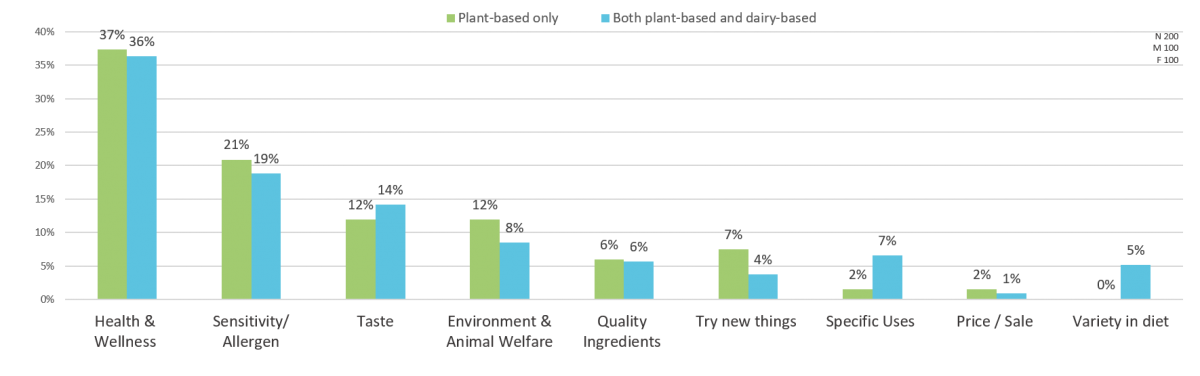

At a macro level, consumers who purchase both plant-based products and dairy-based products are equally motivated by the same reasons as consumers who solely buy plant-based ingredients.

Health & wellness concerns are major purchase drivers, ranking significantly higher than sensitivity/allergen as motivators.

Preferred taste, ecological concerns and product quality are other notable purchase drivers of plant based products.

Consumers who purchase both plant and dairy based products saw an increase in specific uses, heavily impacted by shelf life and preference of use in recipes.

Plant-Based Purchase Motivations

To better understand why consumers are moving to plant-based products, we asked respondents to elaborate on the why behind the buy of plant-based dairy alternatives.

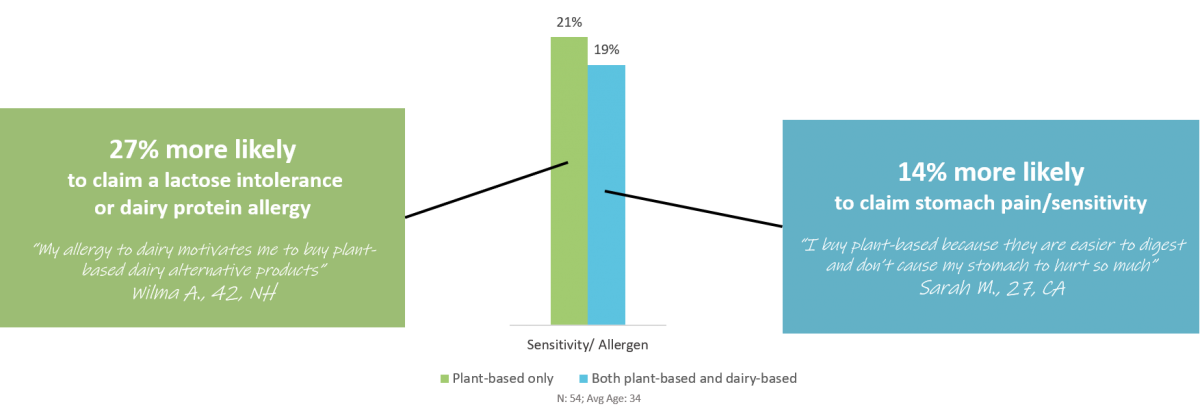

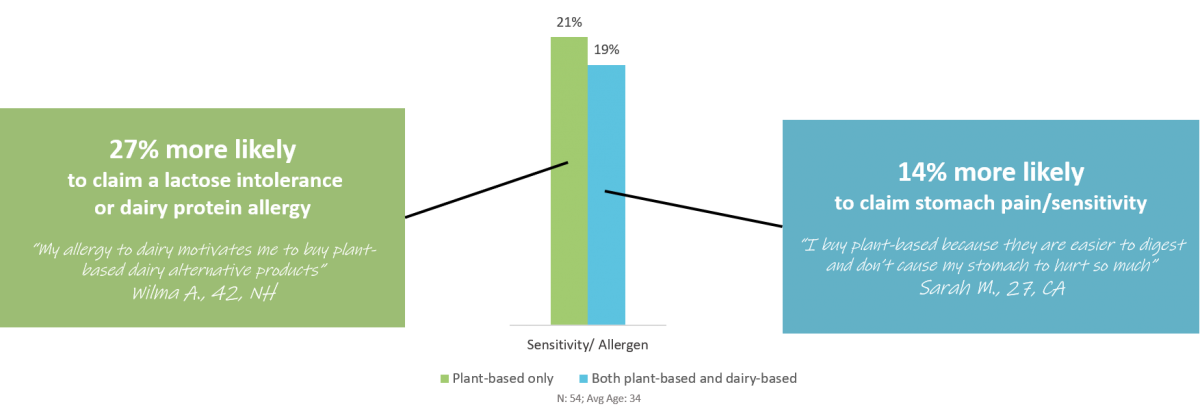

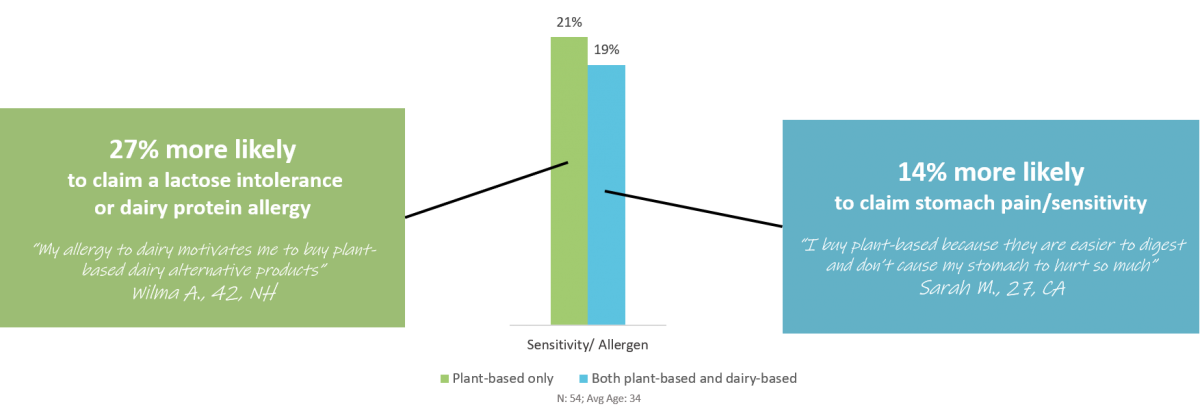

Sensitivity & Allergen Motivations

Digestion sensitivity is the second leading motivation behind purchasing plant-based products; sensitivity was claimed significantly more often than a lactose intolerance or dairy protein allergy diagnosis.

24% of consumers who buy both plant-based and dairy-based products are more likely motivated by a family member who has an allergy or sensitivity.

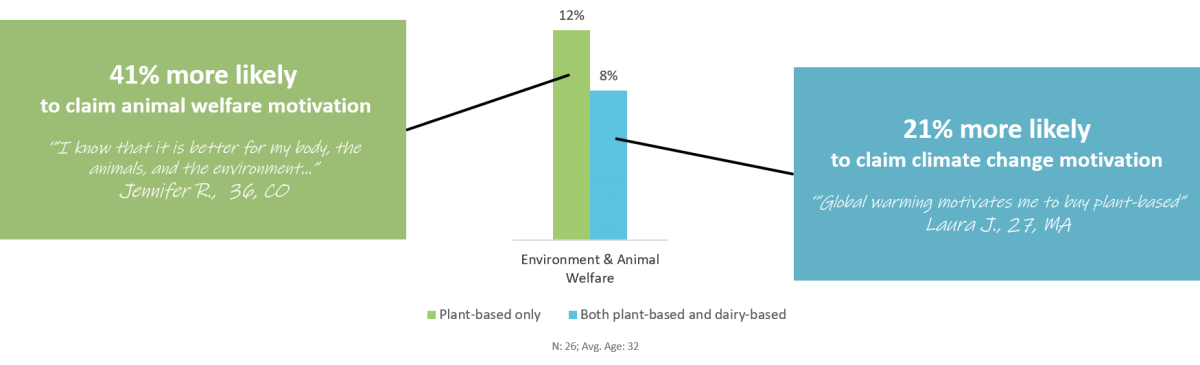

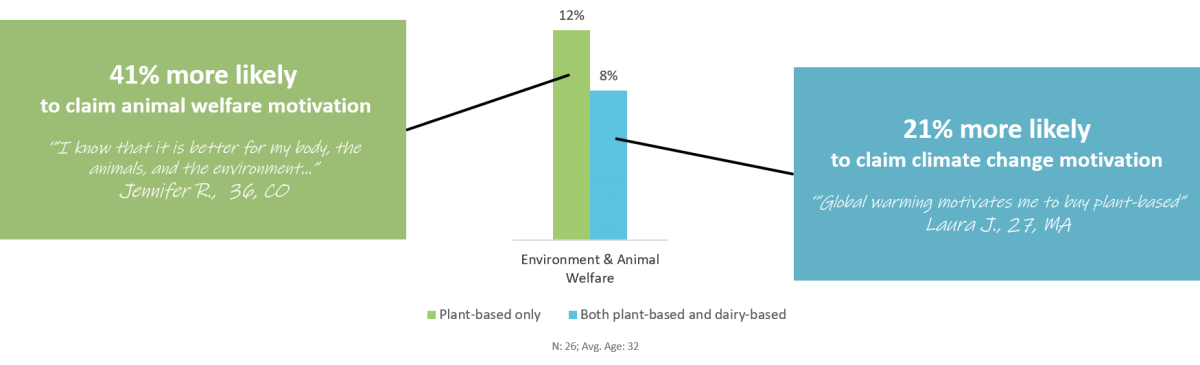

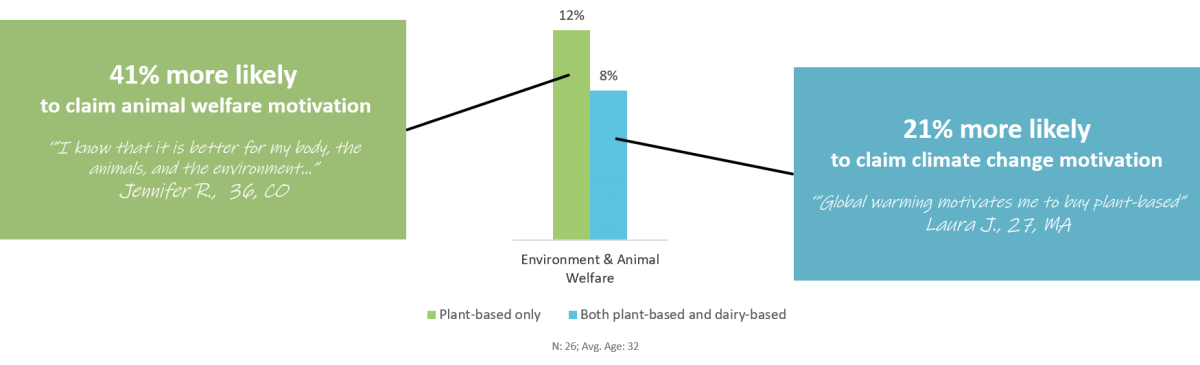

Environment & Animal Welfare Motivations

Buying plant-based to support a more sustainable environment is the top ecological motivation listed by respondents.

Consumers who only purchase plant-based products were more likely to claim animal welfare as a purchase motivation compared to consumers who also or solely purchase dairy-based products.

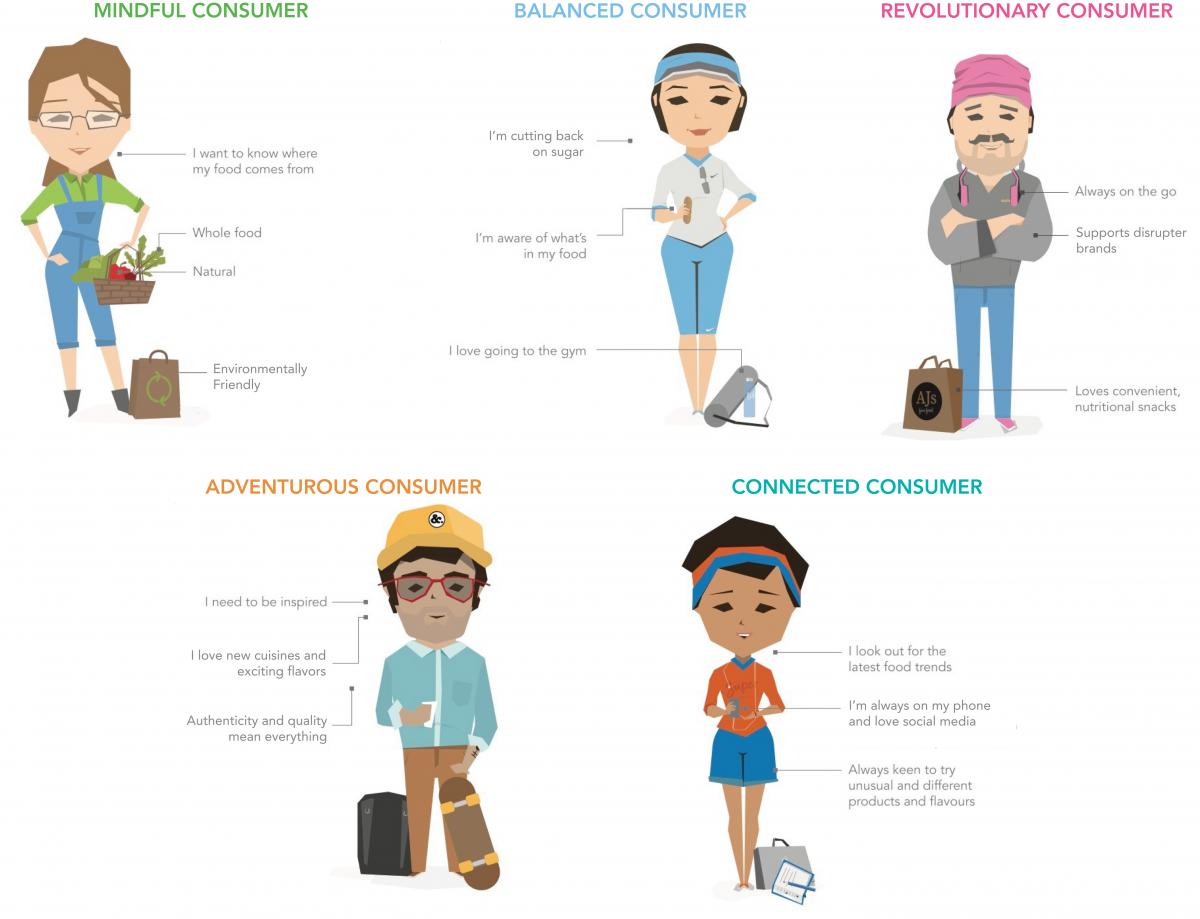

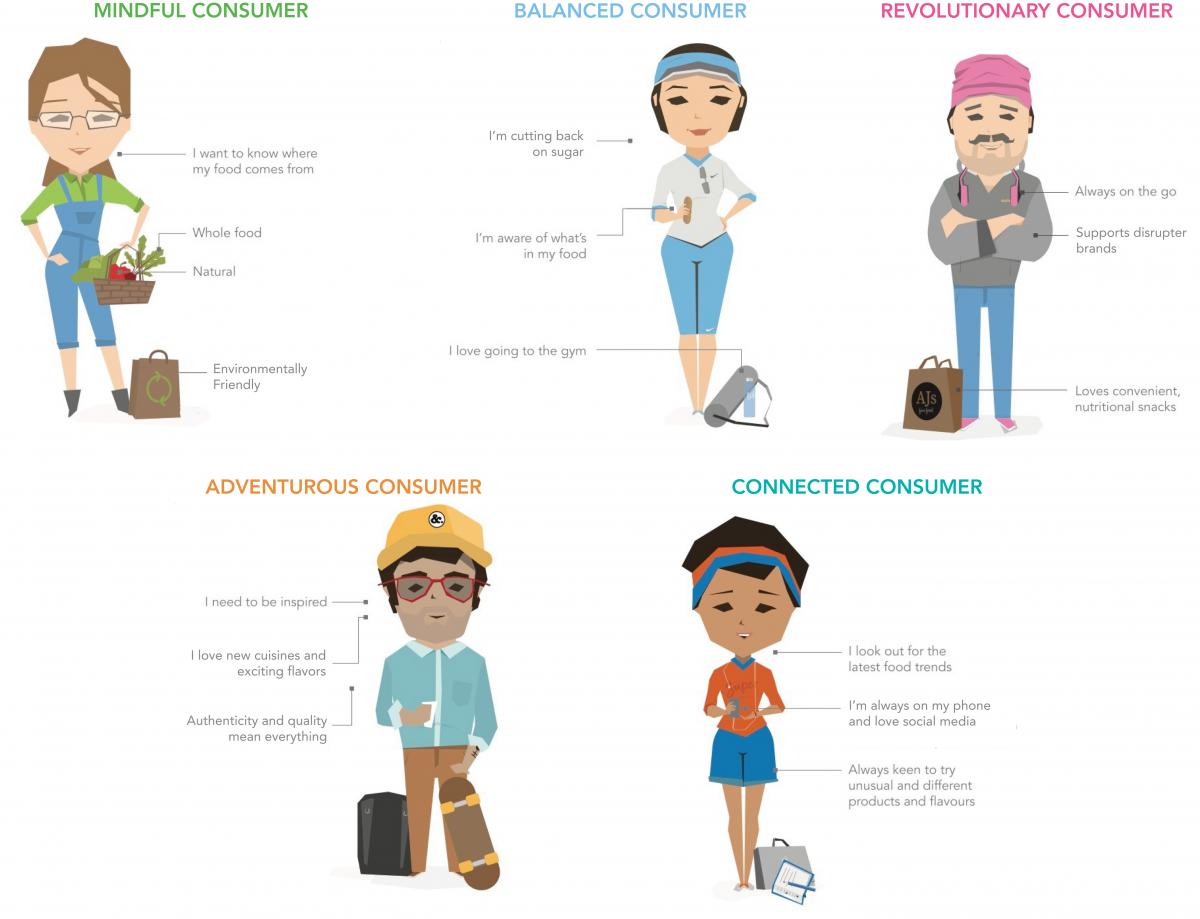

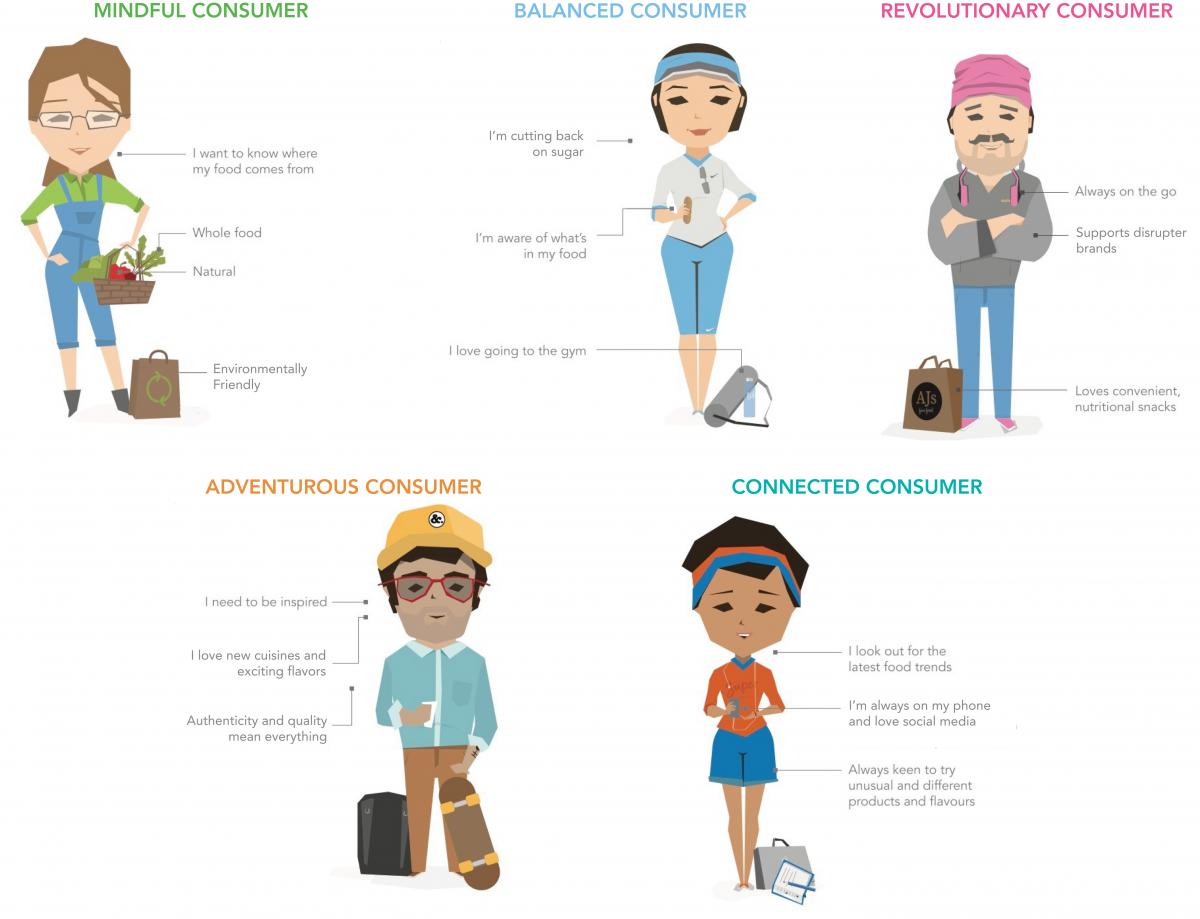

Meet today’s plant-based consumers:

Innovation is best guided by consumer insight

Our research shows that plant-based purchases are primarily motivated by five macro drivers. However, it isn’t until we dive deeper into the analysis and hear directly from real consumers that we can formulate to meet the needs of each plant-based persona.

• Health & Wellness

• Dairy Sensitivity

• Taste

• Ecological Impact

• Quality

Source: Synergy Primary Research 2019

Visit our Plant-based solutions page to find out more about our range of cross-category vegan solutions.

Contact Us

We’re passionate about helping our customers create great products.

Complete the form below to get in touch with a member of our team to leverage our operations for global solutions based on true inspiration.